The COVID-19 Employee Retention Tax Credit (COVID ERC) is one of the many government programs that has been implemented to provide relief to both individuals and businesses in order to ensure that the economy is able to thrive amidst the hardships caused by the pandemic. For many small businesses, this relief means the difference between staying afloat or closing their doors.

But many of these businesses - ranging from security companies to local restaurants - have had difficulty taking advantage of programs like the COVID ERC because they don’t have the time to understand if they qualify or how to apply for the relief.

A Brief History on the CARES Act the Importance of Employee Retention

Before jumping into what Employee Retention Credits are, it’s important to understand where the relief bills that have had a significant impact on keeping businesses alive came from. In March 2020, Congress passed the Coronavirus Aid, Relief and Economic Security (CARES) Act.

The bill provided fast and direct economic relief to American workers, families, small businesses, and industries. Some of that economic relief came in the form of loans and credits, including the Paycheck Protection Program (PPP) for small businesses, economic packages for larger industries, and special tax credits for employee retention. This is where the employee retention credit was born.

Essentially the goal of the retention credit was to provide a measure of relief for employers who were able to keep employees on their payroll. More people employed means a more stable economy – but because of the pandemic’s negative effect on the economy, employers needed financial assistance to keep paying people.

So the government provided employers with a tax credit that reduced the overall payroll taxes that had to be paid each year for all employees. This is a major benefit to employers but can be somewhat confusing and difficult to account for in smaller businesses.

The next few sections are designed to simplify some of the details of the COVID-19 ERC.

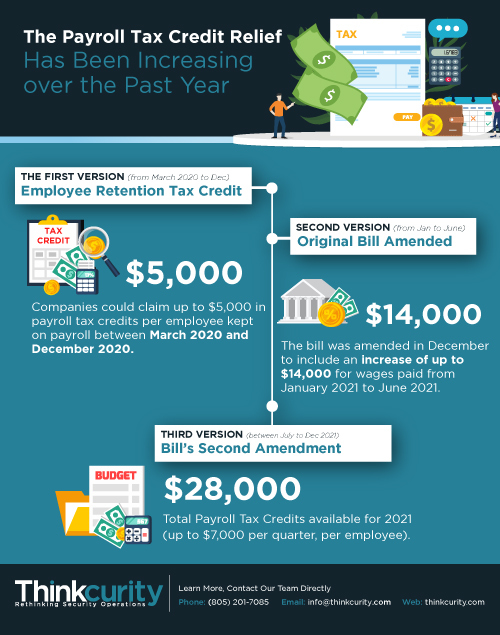

The Payroll Tax Credit Relief Has Been Increasing over the Past Year

The first version of the Employee Retention Tax Credit in the CARES Act was modest. Companies could claim up to $5,000 in payroll tax credits per employee kept on payroll between March 2020 and December 2020.

But as the pandemic wore on the government realized $5,000 wasn’t going to be enough for employers. The bill was amended in December to include an increase of up to $14,000 for wages paid from January 2021 to June 2021.

When Congress saw that this STILL wasn’t enough to help employers for the rest of the year, the credit was amended again to include another up to $14,000 for wages paid from July to December 2021. This means that, if you keep your employee on the payroll for the entire 2021 year, you would be eligible to claim a tax credit of up to $28,000 for that employee ($7,000 per quarter).

(NOTE: All of the tax credit amounts listed in the above section are MAXIMUM AMOUNTS. Not every business that was affected by COVID-19 and applies for these tax credits will receive the full amounts.)

Who is Eligible for the Employee Retention Relief?

When the first iteration of the CARES Act became law, it was limited to companies with 100 or fewer employees that had seen a 50% or more decline in business as a result of the pandemic, compared to the same quarter in 2019. The latest bill expands the small business eligibility to companies with 500 or fewer employees and changed the impact to a 20% decline compared to the same quarter in 2019.

So, if you have under 500 employees, and your business receipts are 20% less than they were in 2019, you are eligible for up to a $28,000 payroll tax credit ($7,000 a quarter) for your employees. This is a major advantage for a lot of businesses, but it’s not as cut-and-dry as explained here, which is why I’ll be answering all of your questions around the specifics of eligibility in my upcoming Thinkcurtiy webinar.

How Security Companies Can Take Advantage of This Important Payroll Tax Credit

While the explanation of the COVID-19 ERC sounds fairly simple, there are a number of conditions and criteria that are important to understand. For example - businesses need to apply for this relief and have to prove their 2019 earnings compared to 2021 earnings.

All of these conditions and criteria can either raise or lower the amount of credit you can receive, so the $28,000 per employee isn’t a guarantee.

Most businesses, when faced with any tax-related issues, are best advised to seek out expert help. Just as you would with your taxes, there are groups out there that have been living and breathing these bills and have been helping businesses with them for well over a year.

For more information on payroll tax credits or to get a question answered directly, feel free to reach out to us at Walton Management services by visiting our website.